01

Automated Compliance Workflows

Reduce manual workload with AI-powered regulatory automation for CECL, HMDA, and Fair Lending compliance.

Simplify compliance processes and enhance operational efficiency ensuring seamless regulatory adherence.

Fill out the form to access powerful analytics that drive better decisions and results!

Regulatory compliance is critical for credit unions, but it shouldn’t be a burden. Rise Analytics’ Regulatory Analytics solution simplifies compliance with automated monitoring, reporting accuracy, and risk assessment tools—ensuring your institution stays ahead of evolving regulations.

Key Features:

CECL & HMDA Compliance

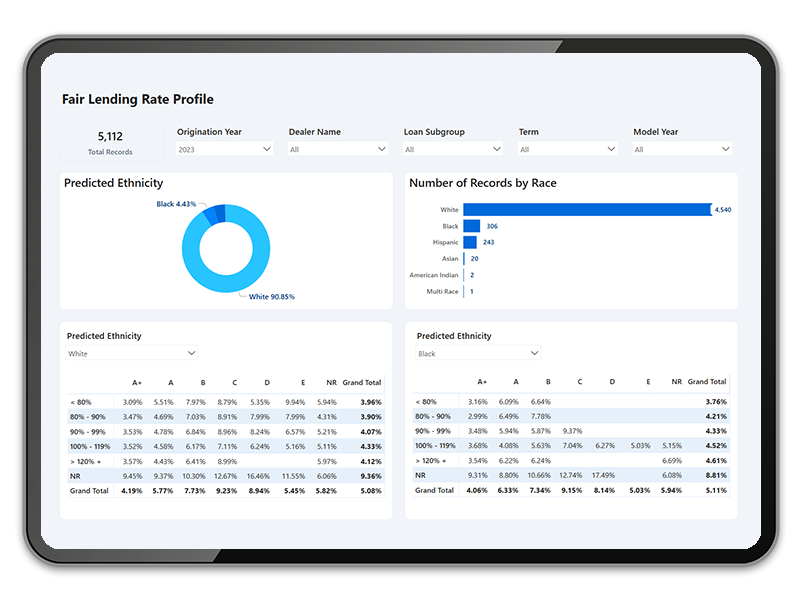

Fair Lending Monitoring

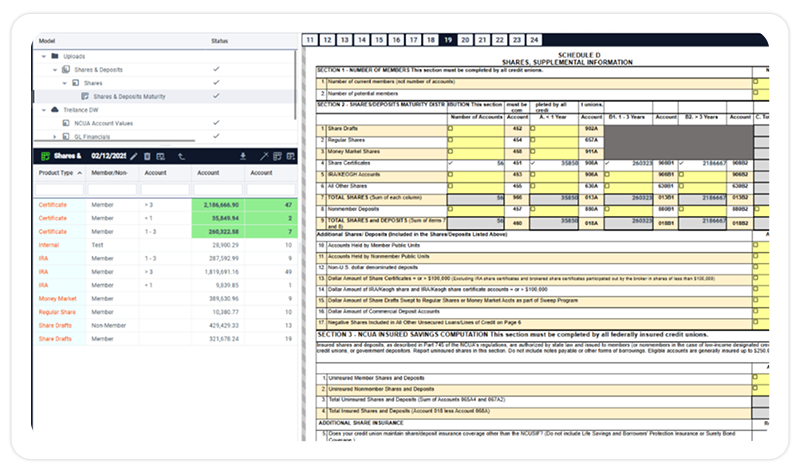

5300 Automation

Regulatory Audit Tracking

Leverage advanced AI-driven compliance automation to streamline reporting, reduce errors, and ensure adherence to CECL, HMDA, Fair Lending, and 5300 regulations. With real-time monitoring, automated workflows, and predictive risk insights, your credit union can stay ahead of regulatory requirements with confidence and accuracy.

What You Get with Loan Analytics

Automated CECL & HMDA Reporting

Fair Lending Compliance Tracking

Regulatory Risk & Audit Insights

5300 Call Report Automation

Fill out the form to access powerful analytics that drive better decisions and results!

Reduce manual workload with AI-powered regulatory automation for CECL, HMDA, and Fair Lending compliance.

Gain real-time visibility into compliance risks and ensure adherence to evolving regulations.

Minimize human errors, improve data accuracy, and enhance regulatory reporting efficiency.

Lower compliance costs by automating audits, tracking regulatory changes, and optimizing internal resources

“With Trellance [now Rise Analytics] insights, our executives have the tools to make decisions and then measure the result of those decisions down to the dollar level.”

Phil Swift

VP of Data Analytics and BI

Centris Federal Credit Union

“This is certainly my favorite and most data progressive project I have been working on, continuing to get new data incorporated into these types of holistic views will be extremely powerful for CalCoast.”

Kevin Dawson

Digital Marketing Director

California Coast Credit Union

Discover how AI-driven compliance monitoring can help your credit union reduce

risk, improve reporting accuracy, and automate regulatory workflows.

Fill out the form to access powerful analytics that drive better decisions and results!