01

Improve Loan Profitability

Optimize loan pricing and yield analysis to maximize profitability across different credit risk tiers.

Gain deeper insights into your loan portfolio's performance and

risk profile to optimize your lending strategies.

Fill out the form to access powerful analytics that drive better decisions and results!

Credit unions need real-time loan insights to maximize lending success while minimizing risk. Rise Analytics’ Loan Analytics solution provides multi-dimensional portfolio analysis, AI-driven risk assessment, and profitability optimization tools to help lenders make smarter, data-backed decisions.

How Loan Analytics Helps You:

Evaluate loan health across multiple risk factors.

Optimize loan pricing and maximize revenue.

Assess risk exposure by simulating market and borrower changes.

Compare portfolio performance against industry peers.

Leverage advanced AI and predictive analytics to track loan portfolio performance, risk factors, and profitability trends in real time. With custom dashboards, automated alerts, and data-driven insights, you can optimize loan pricing, improve risk management, and benchmark performance against industry peers—empowering smarter lending decisions.

What You Get with Loan Analytics

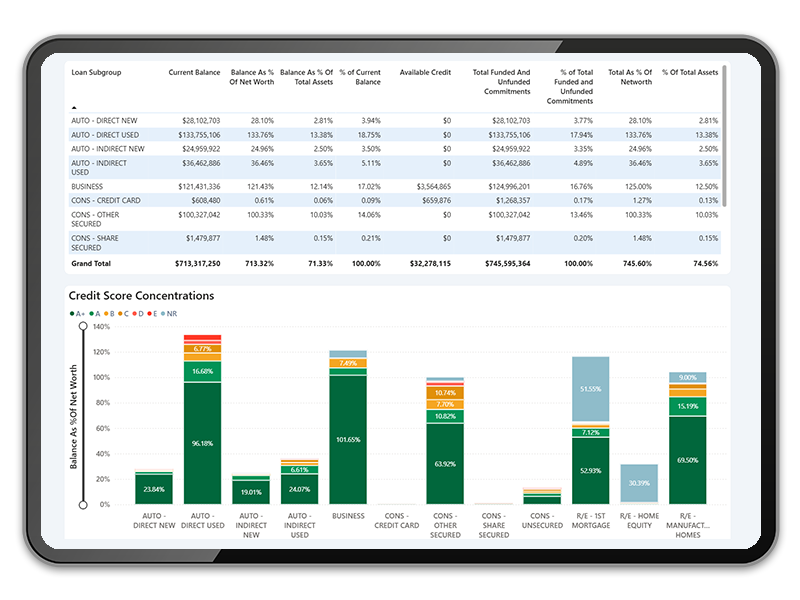

Multi-Dimensional Portfolio Analysis

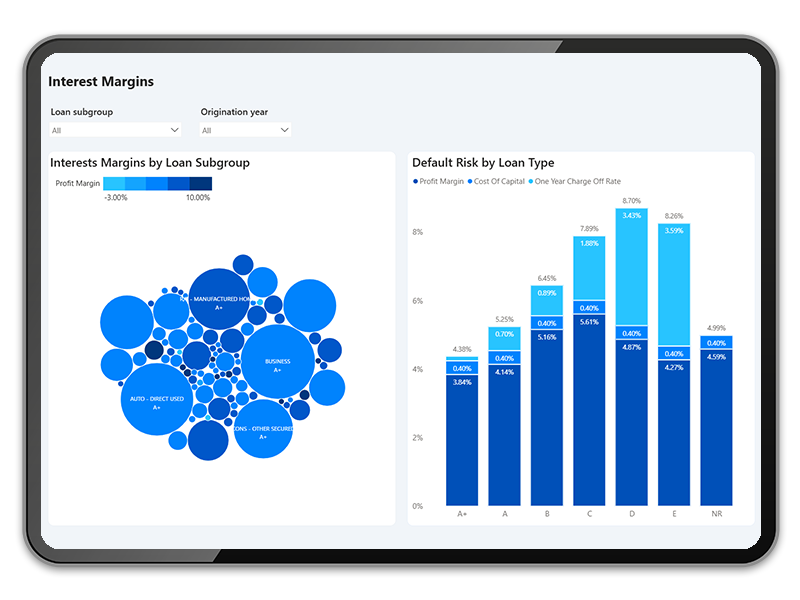

Profitability Assessments

Risk & Default Predictions

Automated Compliance Tracking

Fill out the form to access powerful analytics that drive better decisions and results!

Optimize loan pricing and yield analysis to maximize profitability across different credit risk tiers.

Categorize and evaluate loan portfolios to identify growth opportunities and mitigate risk exposure.

Categorize and evaluate loan portfolios to identify growth opportunities and mitigate risk exposure.

Simulate economic shifts and borrower behaviors while benchmarking against industry standards to identify strengths and areas for improvement.

“With Trellance [now Rise Analytics] insights, our executives have the tools to make decisions and then measure the result of those decisions down to the dollar level.”

Phil Swift

VP of Data Analytics and BI

Centris Federal Credit Union

“This is certainly my favorite and most data progressive project I have been working on, continuing to get new data incorporated into these types of holistic views will be extremely powerful for CalCoast.”

Kevin Dawson

Digital Marketing Director

California Coast Credit Union

Discover how AI-driven loan analytics can help your credit union reduce risk, improve approval rates, and maximize profitability.

Fill out the form to access powerful analytics that drive better decisions and results!